Page 104 - Restamax Plc Annual Report 2017

P. 104

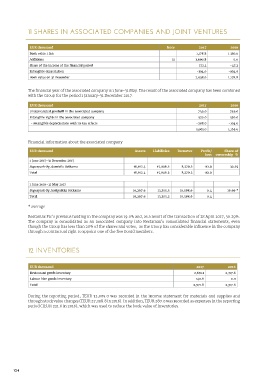

11 SHARES IN ASSOCIATED COMPANIES AND JOINT VENTURES

EUR thousand Note 2017 2016

Book value 1 Jan 1,178.8 1 330.0

Additions 31 1,690.8 0.0

Share of the income of the financial period 172.3 -47.2

Intangible depreciation -104.0 -104.0

Book value on 31 December 2,938.0 1,178.8

The financial year of the associated company is 1 June-31 May. The result of the associated company has been combined

with the Group for the period 1 January-31 December 2017.

EUR thousand 2017 2016

Undepreciated goodwill in the associated company 749.0 749.0

Intangible rights in the associated company 520.0 520.0

- intangible depreciations with its tax effects -208.0 -104.0

1,061.0 1,165.0

Financial information about the associated company

EUR thousand Assets Liabilities Turnover Profit/ Share of

loss ownership %

1 June 2017–31 December 2017

Superpark Oy, domicile Sotkamo 18,612.4 15,096.2 8,379.2 112.9 30.29

Total 18,612.4 15,096.2 8,379.2 112.9

1 June 2016–31 May 2017

Superpark Oy, kotipaikka Sotkamo 16,267.6 13,305.5 10,588.6 0.4 19.96 *

Total 16,267.6 13,305.5 10,588.6 0.4

* average

Restamax Plc’s previous holding in the company was 19.0% and, as a result of the transaction of 28 April 2017, 30.29%.

The company is consolidated as an associated company into Restamax’s consolidated financial statements, even

though the Group has less than 20% of the shares and votes, as the Group has considerable influence in the company

through a contractual right to appoint one of the five Board members.

12 INVENTORIES

EUR thousand 2017 2016

Restaurant goods inventory 2,831.1 2,317.6

Labour hire goods inventory 140.8 0.0

Total 2,971.8 2,317.6

During the reporting period, TEUR 32,005.0 was recorded in the income statement for materials and supplies and

through stock value changes (TEUR 27,398.8 in 2016). In addition, TEUR 280.0 was recorded as expenses in the reporting

period (TEUR 221.6 in 2016), which was used to reduce the book value of inventories.

104