Page 109 - Restamax Plc Annual Report 2017

P. 109

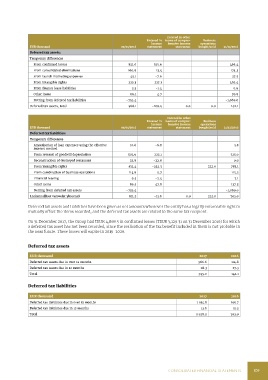

Entered in other

Entered in items of compre- Business

income hensive income operations

EUR thousand 01/01/2016 statement statement bought/sold 31/12/2016

Deferred tax assets:

Temporary differences

From confirmed losses 821.0 -355.6 465.4

From consolidated eliminations 160.9 13.4 174.3

From launch marketing expenses 45.1 -7.6 37.5

From intangible rights 225.3 237.1 462.4

From finance lease liabilities 2.3 -1.4 0.9

Other items 66.1 4.7 70.8

Netting from deferred tax liabilities -752.4 -1,069.0

Deferred tax assets, total 568.1 -109.4 0.0 0.0 142.1

Entered in other

Entered in items of compre- Business

income hensive income operations

EUR thousand 01/01/2016 statement statement bought/sold 31/12/2016

Deferred tax liabilities:

Temporary differences

Amortisation of loan expenses using the effective 10.6 -6.8 3.8

interest method

From reversal of goodwill depreciation 502.9 222.1 725.0

Reconstruction of destroyed restaurant 22.8 -22.8 0.0

From intangible rights 813.4 -252.3 222.0 783.1

From combination of business operations 114.8 0.7 115.5

Financial leasing 9.5 -2.4 7.1

Other items 89.5 47.8 137.3

Netting from deferred tax assets -752.4 -1,069.0

Laskennalliset verovelat yhteensä 811.2 -13.6 0.0 222.0 703.0

Deferred tax assets and liabilities have been given as net amounts whenever the entity has a legally enforceable right to

mutually offset the items recorded, and the deferred tax assets are related to the same tax recipient.

On 31 December 2017, the Group had TEUR 4,868.5 in confirmed losses (TEUR 3,129.31 on 31 December 2016) for which

a deferred tax asset has not been recorded, since the realisation of the tax benefit included in them is not probable in

the near future. These losses will expire in 2019-2026.

Deferred tax assets

EUR thousand 2017 2016

Deferred tax assets due in over 12 months 566.6 114.8

Deferred tax assets due in 12 months 28.3 27.3

Total 595.0 142.1

Deferred tax liabilities

EUR thousand 2017 2016

Deferred tax liabilities due in over 12 months 1 914.8 691.7

Deferred tax liabilities due in 12 months 13.6 11.2

Total 1 928.5 703.0

CONSOLIDATED FINANCIAL STATEMENTS 109