Page 105 - Restamax Plc Annual Report 2017

P. 105

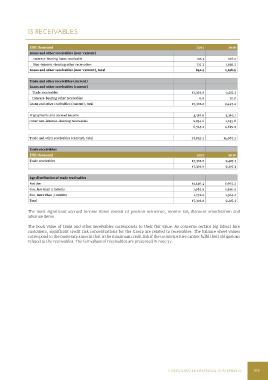

13 RECEIVABLES

EUR thousand 2017 2016

Loans and other receivables (non-current)

Interest-bearing loans receivable 125.3 168.2

Non-interest-bearing other receivables 717.2 1,030.7

Loans and other receivables (non-current), total 842.5 1,198.9

Trade and other receivables (current)

Loans and other receivables (current)

Trade receivables 17,302.0 9,417.3

Interest-bearing other receivables 0.0 30.0

Loans and other receivables (current), total 17,302.0 9,447.2

Prepayments and accrued income 4,510.6 3,364.1

Other non-interest-bearing receivables 2,034.6 1,255.8

6,545.2 4,619.9

Trade and other receivables (current), total 23,847.2 14,067.2

Trade receivables

EUR thousand 2017 2016

Trade receivables 17,302.0 9,417.3

17,302.0 9,417.3

Age distribution of trade receivables

Not due 13,546.4 6,662.2

due, less than 3 months 1,982.9 1,390.9

due, more than 3 months 1,772.6 1,364.2

Total 17,302.0 9,417.3

The most significant accrued income items consist of pension insurance, income tax, discount amortisation and

advance items.

The book value of trade and other receivables corresponds to their fair value. As concerns certain big labour hire

customers, significant credit risk concentrations for the Group are related to receivables. The balance sheet values

correspond to the monetary amount that is the maximum credit risk if the counterparties cannot fulfil their obligations

related to the receivables. The fair values of receivables are presented in note 37.

CONSOLIDATED FINANCIAL STATEMENTS 105