Page 106 - Restamax Plc Annual Report 2017

P. 106

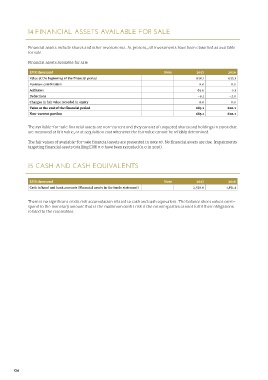

14 FINANCIAL ASSETS AVAILABLE FOR SALE

Financial assets include shares and other investments. At present, all investments have been classified as available

for sale.

Financial assets available for sale

EUR thousand Note 2017 2016

Value at the beginning of the financial period 620.1 622.1

Business combination 0.0 0.0

Additions 65.0 0.1

Deductions -0.1 -2.0

Changes in fair value recorded in equity 0.0 0.0

Value at the end of the financial period 685.1 620.1

Non-current portion 685.1 620.1

The available-for-sale financial assets are non-current and they consist of unquoted shares and holdings in euros that

are measured at fair value, or at acquisition cost whenever the fair value cannot be reliably determined.

The fair values of available-for-sale financial assets are presented in note 36. No financial assets are due. Impairments

targeting financial assets totalling EUR 0.0 have been recorded (0.0 in 2016).

15 CASH AND CASH EQUIVALENTS

EUR thousand Note 2017 2016

Cash in hand and bank accounts (Financial assets in the funds statement) 2,570.0 1,871.1

There is no significant credit risk accumulation related to cash and cash equivalent. The balance sheet values corre-

spond to the monetary amount that is the maximum credit risk if the counterparties cannot fulfil their obligations

related to the receivables.

106