Page 108 - Restamax Plc Annual Report 2017

P. 108

Equity loan

Equity convertible loans include the interest-free capital loans with no maturity that the owners have granted to the

Group. Equity convertible loans have no due date, but the Group has the right (not an obligation) to redeem the loan if

so desired.

Dividends

In 2017, dividends were distributed at EUR 0.30 per share, totalling TEUR 4,985.9 (in 2016, EUR 0.27 per share, totalling

TEUR 4,356.8). After the end of the reporting period, the Board of Directors has proposed a dividend of EUR 0.33 per

share, totalling TEUR 5,484.5 be distributed. The debt from the dividend proposed has not been entered into these

financial statements.

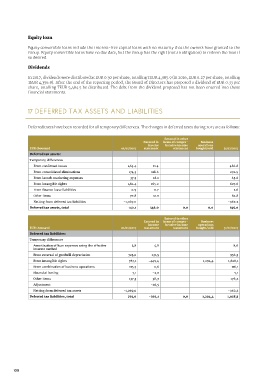

17 DEFERRED TAX ASSETS AND LIABILITIES

Deferred taxes have been recorded for all temporary differences. The changes in deferred taxes during 2017 are as follows:

Entered in other

Entered in items of compre- Business

income hensive income operations

EUR thousand 01/01/2017 statement statement bought/sold 31/12/2017

Deferred tax assets:

Temporary differences

From confirmed losses 465.4 21.4 486.8

From consolidated eliminations 174.3 118.6 292.9

From launch marketing expenses 37.5 28.1 65.6

From intangible rights 462.4 165.2 627.6

From finance lease liabilities 0.9 0.7 1.6

Other items 70.8 12.0 82.8

Netting from deferred tax liabilities -1,069.0 -962.2

Deferred tax assets, total 142.1 346.0 0.0 0.0 595.0

Entered in other

Entered in items of compre- Business

income hensive income operations

EUR thousand 01/01/2017 statement statement bought/sold 31/12/2017

Deferred tax liabilities:

Temporary differences

Amortisation of loan expenses using the effective 3,8 4,8 8,6

interest method

From reversal of goodwill depreciation 725,0 231,5 956,5

From intangible rights 783,1 -449,4 1,294,4 1,628,1

From combination of business operations 115,5 0,6 116,1

Financial leasing 7,1 -2,0 5,1

Other items 137,3 38,9 176,2

Adjustment -26,5

Netting from deferred tax assets -1,069,0 -962,2

Deferred tax liabilities, total 703,0 -202,1 0,0 1,294,4 1,928,5

108