Page 111 - Restamax Plc Annual Report 2017

P. 111

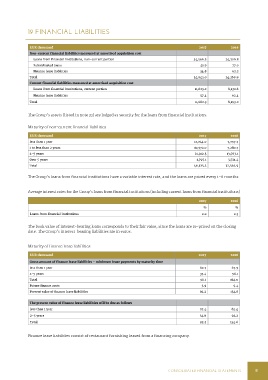

19 FINANCIAL LIABILITIES

EUR thousand 2017 2016

Non-current financial liabilities measured at amortised acquisition cost

Loans from financial institutions, non-current portion 34,566.2 24,200.8

Subordinated loans 41.9 77.0

Finance lease liabilities 34.8 92.2

Total 34,643.0 24,369.9

Current financial liabilities measured at amortised acquisition cost

Loans from financial institutions, current portion 11,625.2 8,130.6

Finance lease liabilities 57.4 62.4

Total 11,682.5 8,193.0

The Group’s assets (listed in note 33) are lodged as security for the loans from financial institutions.

Maturity of non-current financial liabilities

EUR thousand 2017 2016

less than 1 year 12,044.0 7,797.7

1 to less than 2 years 10,572.0 7,280.7

2-5 years 21,912.5 13,763.1

Over 5 years 1,797.1 3,721.4

Total 46,325.5 32,562.9

The Group’s loans from financial institutions have a variable interest rate, and the loans are priced every 1–6 months.

Average interest rates for the Group’s loans from financial institutions (including current loans from financial institutions)

2017 2016

% %

Loans from financial institutions 2.0 2.3

The book value of interest-bearing loans corresponds to their fair value, since the loans are re-priced on the closing

date. The Group’s interest-bearing liabilities are in euros.

Maturity of finance lease liabilities

EUR thousand 2017 2016

Gross amount of finance lease liabilities – minimum lease payments by maturity time

less than 1 year 60.7 67.9

2-5 years 35.4 96.1

Total 96.1 164.0

Future finance costs 3.9 9.4

Present value of finance lease liabilities 92.2 154.6

The present value of finance lease liabilities will be due as follows

less than 1 year 57.4 62.4

2–5 years 34.8 92.2

Total 92.2 154.6

Finance lease liabilities consist of restaurant furnishing leased from a financing company.

CONSOLIDATED FINANCIAL STATEMENTS 111