Page 96 - Restamax Plc Annual Report 2017

P. 96

On 14 November 2016, Restamax Plc agreed with the owners of Restala Oy on the exchange of shares, whereby Restamax

Plc acquired the entire share capital of Restala Oy, 116,465 shares, in a private placement by issuing 440,000.00 Restamax

Plc shares to the owners of Restala Oy. Restala Oy owns 82 per cent of Unioninkadun keidas Oy, which engages in the

restaurant business.

With a deed of sale dated 15 November 2016, Restamax purchased 18 per cent of the shares in Unioninkadun keidas Oy,

which is engaged in the restaurant business.

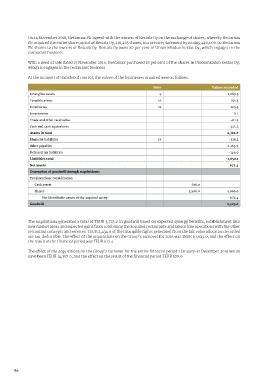

At the moment of transfer of control, the values of the businesses acquired were as follows:

Note Values recorded

Intangible assets 9 1,089.3

Tangible assets 10 391.3

Inventories 12 205.3

Investments 0.1

Trade and other receivables 411.3

Cash and cash equivalents 225.2

Assets in total 2,322.6

Financial liabilities 19 -338.3

Other payables -1,165.9

Deferred tax liabilities -146.0

Liabilities total -1,650.1

Net assets 672.4

Generation of goodwill through acquisitions:

Total purchase consideration

Cash assets 500.0

Shares 2,596.0 3,096.0

Net identifiable assets of the acquired entity 672.4

Goodwill 2,423.6

The acquisitions generated a total of TEUR 3,723.0 in goodwill based on expected synergy benefits, establishment into

new market areas and expected gains from combining the acquired restaurants and labour hire operations with the other

restaurant concepts and services. TEUR 2,434.6 of the intangible rights generated from the fair value allocation recorded

are tax-deductible. The effect of the acquisitions on the Group’s turnover for 2016 was TEUR 10,023.0, and the effect on

the result of the financial period was TEUR 612.4.

The effect of the acquisitions on the Group’s turnover for the entire financial period 1 January-31 December 2016 would

have been TEUR 14,357.6, and the effect on the result of the financial period TEUR 570.9.

96