Page 93 - Restamax Plc Annual Report 2017

P. 93

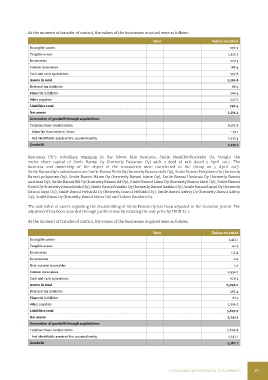

At the moment of transfer of control, the values of the businesses acquired were as follows:

Note Values recorded

Intangible assets 976.9

Tangible assets 1,325.2

Inventories 279.5

Current receivables 188.4

Cash and cash equivalents 559.8

Assets in total 3,329.8

Deferred tax liabilities 68.3

Financial liabilities 200.4

Other payables 527.7

Liabilities total 796.4

Net assets 2,533.4

Generation of goodwill through acquisitions:

Total purchase consideration 6,187.8

Minority shareholders’ share -79.1

Net identifiable assets of the acquired entity 2,533.4

Goodwill 3,733.5

Restamax Plc’s subsidiary engaging in the labour hire business, Smile Henkilöstöpalvelut Oy, bought the

entire share capital of Smile Banssi Oy (formerly Pasianssi Oy) with a deed of sale dated 5 April 2017. The

business and ownership of the object of the transaction were transferred to the Group on 5 April 2017.

Smile Banssi Oy’s subsidiaries are Smile Banssi Etelä Oy (formerly Banssi etelä Oy), Smile Banssi Pohjoinen Oy (formerly

Banssi pohjoinen Oy), Smile Banssi Häme Oy (formerly Banssi häme Oy), Smile Banssi Uusimaa Oy (formerly Banssi

uusimaa Oy), Smile Banssi Itä Oy (formerly Banssi itä Oy), Smile Banssi Länsi Oy (formerly Banssi länsi Oy), Smile Banssi

Keski Oy (formerly Banssi keski Oy), Smile Banssi Kaakko Oy (formerly Banssi kaakko Oy), Smile Banssi Lappi Oy (formerly

Banssi lappi Oy), Smile Banssi Helsinki Oy (formerly Banssi Helsinki Oy), Smile Banssi Safety Oy (formerly Banssi Safety

Oy), Smile Rmax Oy (formerly Banssi Hoiva Oy) and Talous Bandora Oy.

The sale value of assets regarding the shareholding of Smile Banssi Oy has been adjusted in the financial period. The

adjustment has been recorded through profit or loss by reducing the sale price by TEUR 75.1.

At the moment of transfer of control, the values of the businesses acquired were as follows:

Note Values recorded

Intangible assets 2,412.1

Tangible assets 42.3

Inventories 112.4

Investments 0.9

Non-current receivables 1.0

Current receivables 2,552.7

Cash and cash equivalents 970.5

Assets in total 6,092.0

Deferred tax liabilities 482.4

Financial liabilities 61.2

Other payables 3,306.3

Liabilities total 3,849.9

Net assets 2,242.1

Generation of goodwill through acquisitions:

Total purchase consideration 7,609.8

Net identifiable assets of the acquired entity 2,242.1

Goodwill 5,367.7

CONSOLIDATED FINANCIAL STATEMENTS 93