Page 95 - Restamax Plc Annual Report 2017

P. 95

Acquisitions during the 2016 financial period

Acquired subsidiaries and businesses

Restamax Plc’s subsidiary engaging in the restaurant business purchased the restaurant business of Food Bar & Kitchen

operating in Jyväskylä through a deed of sale dated 2 January 2016.

Restamax Plc’s subsidiary engaging in the labour hire business purchased the labour hire business of TOR through a deed

of sale dated 1 January 2016.

Restamax Plc’s subsidiary engaging in the restaurant business purchased the restaurant business of restaurant Namu and

Showroom located in Helsinki through a deed of sale dated 24 March 2016. The business operations were transferred to

Restamax Group on 1 April 2016.

Restamax Plc’s subsidiary engaging in the labour hire business purchased 70% of the share capital of limited liability

company Make My Solutions Oy with a deed of sale dated 23 March 2016 (the name of the company was changed to Smile

MMS Oy on 2 May 2015). Smile MMS Oy owns 70% of the share capital of Smile MMS Työllistämispalvelut Oy, which

engages in the labour hire business. The ownership of the shares which the transaction concerns was transferred to

Restamax Group on 1 May 2016.

Restamax Plc purchased 80 per cent of the share capital of Urban Group Oy with a deed of sale dated 29 April 2016. Urban

Group Oy owns 100% of the share capital of Cholo Oy, which engages in the restaurant business, and 100% of the share

capital of Sabor a México Oy, which engages in the restaurant business. The ownership of the shares which the transac-

tion concerns was transferred to Restamax Group on signing the deed of sale.

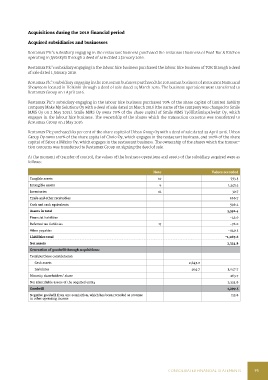

At the moment of transfer of control, the values of the business operations and assets of the subsidiary acquired were as

follows:

Note Values recorded

Tangible assets 10 753.5

Intangible assets 9 1,345.3

Inventories 12 30.7

Trade and other receivables 666.7

Cash and cash equivalents 596.2

Assets in total 3,392.4

Financial liabilities -42.0

Deferred tax liabilities 17 -76.0

Other payables -949.5

Liabilities total -1,067.6

Net assets 2,324.8

Generation of goodwill through acquisitions:

Total purchase consideration

Cash assets 2,643.0

Liabilities 404.7 3,047.7

Minority shareholders’ share 263.7

Net identifiable assets of the acquired entity 2,324.8

Goodwill 1,299.5

Negative goodwill from one acquisition, which has been recorded as revenue -312.8

in other operating income

CONSOLIDATED FINANCIAL STATEMENTS 95