Page 94 - Restamax Plc Annual Report 2017

P. 94

With a deed of sale dated 1 July 2017, Restamax Plc’s subsidiary engaging in the labour hire business purchased 100% of the

shares in Smile Job Services One Oy (formerly Job Services One Oy). The right of ownership of the shares was transferred on

1 July 2017. A part of the sale price has been paid with Restamax Plc subsidiary’s shares involving a fixed-term repurchase

obligation. At the time of the closing of the accounts, the recorded sale price includes a share, which includes an assessment

by the management on the future, final sale price to materialise.

The estimated additional purchase price regarding the shareholding of Smile Job Services One Oy has been adjusted in the

financial period. The adjustment has been recorded through profit or loss by increasing the sale price by TEUR 1,711.1.

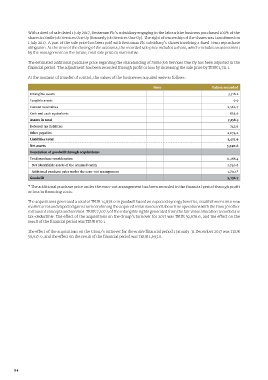

At the moment of transfer of control, the values of the businesses acquired were as follows:

Note Values recorded

Intangible assets 3,718.2

Tangible assets 9.9

Current receivables 2,564.7

Cash and cash equivalents 865.6

Assets in total 7,158.5

Deferred tax liabilities 743.6

Other payables 2,674.2

Liabilities total 3,417.9

Net assets 3,740.6

Generation of goodwill through acquisitions:

Total purchase consideration 11,188.4

Net identifiable assets of the acquired entity 3,740.6

Additional purchase price under the earn-out arrangement 1,711.1*

Goodwill 5,736.7

* The additional purchase price under the earn-out arrangement has been recorded in the financial period through profit

or loss in financing costs.

The acquisitions generated a total of TEUR 14,838.0 in goodwill based on expected synergy benefits, establishment into new

market areas and expected gains from combining the acquired restaurants and labour hire operations with the Group's other

restaurant concepts and services. TEUR 7,107.3 of the intangible rights generated from the fair value allocation recorded are

tax-deductible. The effect of the acquisitions on the Group's turnover for 2017 was TEUR 39,676.6, and the effect on the

result of the financial period was TEUR 670.1.

The effect of the acquisitions on the Group's turnover for the entire financial period 1 January-31 December 2017 was TEUR

59,617.0, and the effect on the result of the financial period was TEUR 1,693.0.

94