Page 115 - Restamax Plc Annual Report 2017

P. 115

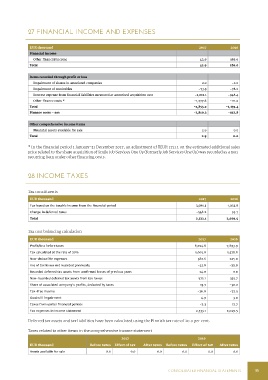

27 FINANCIAL INCOME AND EXPENSES

EUR thousand 2017 2016

Financial income

Other financial income 42.9 186.6

Total 42.9 186.6

Items recorded through profit or loss

Impairment of shares in associated companies 0.0 -2.0

Impairment of receivables -73.5 -78.0

Interest expense from financial liabilities measured at amortised acquisition cost -1,002.1 -948.4

Other finance costs * -1,777.6 -111.0

Total -2,853.2 -1,139.4

Finance costs – net -2,810.3 -952.8

Other comprehensive income items

Financial assets available for sale 2.9 0.0

Total 2.9 0.0

* In the financial period 1 January-31 December 2017, an adjustment of TEUR 1711.1 on the estimated additional sales

price related to the share acquisition of Smile Job Services One Oy (formerly Job Services One Oy) was recorded as a non-

recurring item under other financing costs.

28 INCOME TAXES

Tax constituents

EUR thousand 2017 2016

Tax based on the taxable income from the financial period 3,081.3 1,933.8

Change in deferred taxes -548.2 95.7

Total 2,533.1 2,029.5

Tax cost balancing calculation

EUR thousand 2017 2016

Profit/loss before taxes 8,024.8 7,893.9

Tax calculated at the rate of 20% 1,605.0 1,578.8

Non-deductible expenses 382.6 225.0

Use of tax losses not recorded previously -43.8 -22.9

Recorded deferred tax assets from confirmed losses of previous years 24.0 0.0

Non-recorded deferred tax assets from tax losses 575.1 335.7

Share of associated company's profits, deducted by taxes 13.7 -30.2

Tax-free income -26.0 -72.5

Goodwill impairment 4.9 3.0

Taxes from earlier financial periods -2.3 12.7

Tax expenses in income statement 2,533.1 2,029.5

Deferred tax assets and tax liabilities have been calculated using the Finnish tax rate of 20.0 per cent.

Taxes related to other items in the comprehensive income statement

2017 2016

EUR thousand Before taxes Effect of tax After taxes Before taxes Effect of tax After taxes

Assets available for sale 0.0 0.0 0.0 0.0 0.0 0.0

CONSOLIDATED FINANCIAL STATEMENTS 115