Page 143 - Restamax Plc Annual Report 2017

P. 143

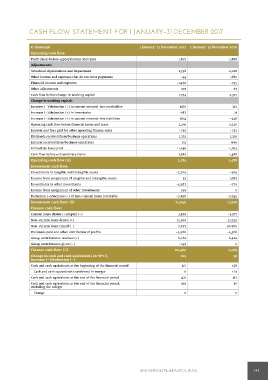

CASH FLOW STATEMENT FOR 1 JANUARY–31 DECEMBER 2017

€ thousand 1 January–31 December 2017 1 January–31 December 2016

Operating cash flow:

Profit (loss) before appropriations and taxes 1,807 1,888

Adjustments:

Scheduled depreciations and impairment 1,758 2,028

Other income and expenses that do not incur payments -54 -889

Financial income and expenses -1,470 -755

Other adjustments -307 83

Cash flow before change in working capital 1,734 2,355

Change in working capital:

Increase (-)/deduction (+) in current interest-free receivables -1170 319

Increase (-)/deduction (+) in inventories -187 21

Increase (-)/deduction (+) in current interest-free liabilities 1914 -948

Operating cash flow before financial items and taxes 2,291 1,746

Interest and fees paid for other operating finance costs -755 -757

Dividends received from business operations 1,233 1,516

Interest received from business operations 151 896

Immediate taxes paid -1,636 -1,914

Cash flow before extraordinary items 1,285 1,488

Operating cash flow (A) 1,285 1,488

Investment cash flow:

Investments in tangible and intangible assets -4,709 -984

Income from assignment of tangible and intangible assets 55 1,082

Investments in other investments -4,367 -779

Income from assignment of other investments 199 0

Deduction (+)/increase (-) of non-current loans receivable -2,826 -2,245

Investment cash flow: (B) -11,649 -2,926

Finance cash flow:

Current loans drawn (+)/repaid (-) 3,565 -1,367

Non-current loans drawn (+) 13,560 21,740

Non-current loans repaid (-) -7,673 -20,960

Dividends paid and other distribution of profits -4,986 -4,368

Group contributions received (+) 6,162 6,424

Group contributions given (-) -159 0

Finance cash flow: (C) 10,469 1,469

Change in cash and cash equivalents (A+B+C), 105 30

increase (+)/deduction (-)

Cash and cash equivalents at the beginning of the financial period 315 158

Cash and cash equivalents transferred in merger 0 126

Cash and cash equivalents at the end of the financial period 421 315

Cash and cash equivalents at the end of the financial period, 105 30

excluding the merger

Change 0 0

EMOYHTIÖN TILINPÄÄTÖS (FAS) 143