Page 141 - Restamax Plc Annual Report 2017

P. 141

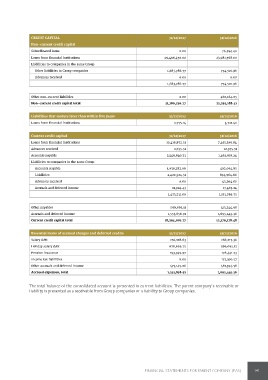

CREDIT CAPITAL 31/12/2017 31/12/2016

Non-current credit capital

Subordinated loans 0.00 76,954.40

Loans from financial institutions 29,496,450.00 23,981,568.00

Liabilities to companies in the same Group

Other liabilities to Group companies 1,683,786.77 774,501.96

Advances received 0.00 0.00

1,683,786.77 774,501.96

Other non-current liabilities 0.00 460,164.05

Non-current credit capital total 31,180,236.77 25,293,188.41

Liabilities that mature later than within five years 31/12/2017 31/12/2016

Loans from financial institutions 1,755.14 3,721.40

Current credit capital 31/12/2017 31/12/2016

Loans from financial institutions 10,419,872.51 7,461,309.84

Advances received 1,635.51 12,575.31

Accounts payable 2,548,840.73 1,462,816.24

Liabilities to companies in the same Group

Accounts payable 1,039,282.06 402,094.85

Liabilities 2,422,524.51 674,964.66

Advances received 0.00 43,264.00

Accruals and deferred income 11,924.43 13,463.24

3,473,731.00 1,133,786.75

Other payables 596,063.11 413,244.98

Accruals and deferred income 1,553,858.91 1,695,445.36

Current credit capital total 18,594,001.77 12,179,178.48

Essential items of accrued charges and deferred credits 31/12/2017 31/12/2016

Salary debt 256,108.63 266,215.36

Holiday salary debt 628,659.25 596,093.12

Pension insurance 193,945.97 178,441.73

Income tax liabilities 0.00 173,300.57

Other accruals and deferred income 475,145.06 481,394.58

Accrued expenses, total 1,553,858.91 1,695,445.36

The total balance of the consolidated account is presented in current liabilities. The parent company’s receivable or

liability is presented as a receivable from Group companies or a liability to Group companies.

FINANCIAL STATEMENTS FOR PARENT COMPANY (FAS) 141