Page 125 - Restamax Plc Annual Report 2017

P. 125

Trade and other receivables

The original book value of the receivables corresponds to their fair value, since the effect of discounting is not

relevant when considering the maturity of the receivables.

Financial assets recorded at fair value through profit or loss

Financial assets recorded at fair value through profit or loss include financial asset items that have been acquired to

be held for trading or that are classified to be recorded at fair value through profit or loss upon original recording.

Financial liabilities

The fair values of liabilities are based on discounted cash flows. The discount rate used has been the rate at which the

Group could take out a similar external loan on the closing date. The total interest consists of the risk-free interest

and a company-specific risk premium. The re-pricing date for the loans is 31 December, which means that the book

values for the loans correspond to their market values.

Trade payables and other liabilities

EUR thousand Other assets Liabilities related to financing

Cash and cash Liquid Loans within Loans in more The original book value of the trade and other receivables corresponds to their fair value, since the effect of

equivalents/ investments one year than one year

credit Accounts Total discounting is not relevant when considering the maturity of the receivables.

Net liabilities 31 December 2016 1,871.1 -7,797.7 -24,765.2 -30,691.8

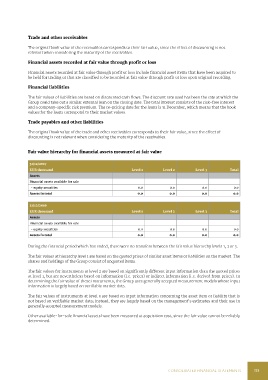

Cash flows 698.9 -4,246.2 -9,254.8 -12,802.1 Fair value hierarchy for financial assets measured at fair value

Acquisitions of subsidiaries - loans -261.6 -261.6

Net liabilities 31 December 2017 2,570.0 0.0 -12,044.0 -34,281.5 -43,755.5 31/12/2017

EUR thousand Level 1 Level 2 Level 3 Total

Assets

Financial assets available for sale

- equity securities 0.0 0.0 0.0 0.0

Assets in total 0.0 0.0 0.0 0.0

31/12/2016

EUR thousand Level 1 Level 2 Level 3 Total

Assets

Financial assets available for sale

- equity securities 0.0 0.0 0.0 0.0

Assets in total 0.0 0.0 0.0 0.0

During the financial period which has ended, there were no transfers between the fair value hierarchy levels 1, 2 or 3.

The fair values at hierarchy level 1 are based on the quoted prices of similar asset items or liabilities on the market. The

shares and holdings of the Group consist of unquoted items.

The fair values for instruments at level 2 are based on significantly different input information than the quoted prices

at level 1, but are nevertheless based on information (i.e. prices) or indirect information (i.e. derived from prices). In

determining the fair value of these instruments, the Group uses generally accepted measurement models whose input

information is largely based on verifiable market data.

The fair values of instruments at level 3 are based on input information concerning the asset item or liability that is

not based on verifiable market data; instead, they are largely based on the management’s estimates and their use in

generally accepted measurement models.

Other available-for-sale financial assets have been measured at acquisition cost, since the fair value cannot be reliably

determined.

CONSOLIDATED FINANCIAL STATEMENTS 125