Page 124 - Restamax Plc Annual Report 2017

P. 124

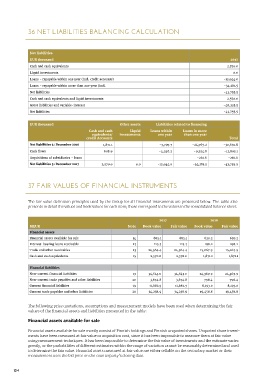

36 NET LIABILITIES BALANCING CALCULATION

Net liabilities

EUR thousand 2017

Cash and cash equivalents 2,570.0

Liquid investments 0.0

Loans - repayable within one year (incl. credit accounts) -12,044.0

Loans - repayable within more than one year (incl. -34,281.5

Net liabilities -43,755.5

Cash and cash equivalents and liquid investments 2,570.0

Gross liabilities and variable-interest -46,325.5

Net liabilities -43,755.5

EUR thousand Other assets Liabilities related to financing

Cash and cash Liquid Loans within Loans in more

equivalents/ investments one year than one year

credit Accounts Total

Net liabilities 31 December 2016 1,871.1 -7,797.7 -24,765.2 -30,691.8

Cash flows 698.9 -4,246.2 -9,254.8 -12,802.1

Acquisitions of subsidiaries - loans -261.6 -261.6

Net liabilities 31 December 2017 2,570.0 0.0 -12,044.0 -34,281.5 -43,755.5

37 FAIR VALUES OF FINANCIAL INSTRUMENTS

The fair value definition principles used by the Group for all financial instruments are presented below. The table also

presents in detail the values and book values for each item; these correspond to the values in the consolidated balance sheet.

2017 2016

MEUR Note Book value Fair value Book value Fair value

Financial assets

Financial assets available for sale 14 685.1 685.1 620.2 620.2

Interest-bearing loans receivable 13 125.3 125.3 198.2 198.2

Trade and other receivables 13 24,564.4 24,564.4 15,067.9 15,067.9

Cash and cash equivalents 15 2,570.0 2,570.0 1,871.1 1,871.1

Financial liabilities

Non-current financial liabilities 19 34,643.0 34,643.0 24,369.9 24,369.9

Non-current trade payables and other liabilities 20 3,674.8 3,674.8 796.4 796.4

Current financial liabilities 19 11,682.5 11,682.5 8,193.0 8,193.0

Current trade payables and other liabilities 20 34,238.9 34,238.9 19,458.8 19,458.8

The following price quotations, assumptions and measurement models have been used when determining the fair

values of the financial assets and liabilities presented in the table:

Financial assets available for sale

Financial assets available for sale mostly consist of Finnish holdings and Finnish unquoted shares. Unquoted share invest-

ments have been measured at fair value or acquisition cost, since it has been impossible to measure them at fair value

using measurement techniques. It has been impossible to determine the fair value of investments and the estimate varies

greatly, or the probabilities of different estimates within the range of variation cannot be reasonably determined and used

to determine the fair value. Financial assets measured at fair value are either sellable on the secondary market or their

measurement uses the bid price on the counterparty’s closing date.

124