Page 122 - Restamax Plc Annual Report 2017

P. 122

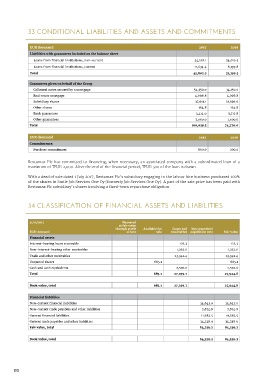

33 CONDITIONAL LIABILITIES AND ASSETS AND COMMITMENTS

EUR thousand 2017 2016

Liabilities with guarantees included on the balance sheet

Loans from financial institutions, non-current 34,168.1 24,010.5

Loans from financial institutions, current 11,634.4 8,139.8

Total 45,802.5 32,150.3

Guarantees given on behalf of the Group

Collateral notes secured by a mortgage 54,350.0 34,150.0

Real estate mortgage 4,096.8 4,096.8

Subsidiary shares 37,613.1 31,596.6

Other shares 164.8 164.8

Bank guarantees 3,414.9 3,717.8

Other guarantees 7,000.0 1,000.0

Total 106,639.5 74,726.0

EUR thousand 2017 2016

Commitments:

Purchase commitment 600.0 200.0

Restamax Plc has committed to financing, when necessary, an associated company with a subordinated loan of a

maximum of TEUR 2,000. After the end of the financial period, TEUR 500 of the loan is drawn.

With a deed of sale dated 1 July 2017, Restamax Plc’s subsidiary engaging in the labour hire business purchased 100%

of the shares in Smile Job Services One Oy (formerly Job Services One Oy). A part of the sale price has been paid with

Restamax Plc subsidiary’s shares involving a fixed-term repurchase obligation.

34 CLASSIFICATION OF FINANCIAL ASSETS AND LIABILITIES

31/12/2017 Measured

at fair value

through profit Available for Loans and Into amortised

EUR thousand or loss sale receivables acquisition cost Fair value

Financial assets

Interest-bearing loans receivable 125.3 125.3

Non-interest-bearing other receivables 1,222.0 1,222.0

Trade and other receivables 23,342.4 23,342.4

Unquoted shares 685.1 685.1

Cash and cash equivalents 2,570.0 2,570.0

Total 685.1 27,259.7 27,944.8

Book value, total 685.1 27,259.7 27,944.8

Financial liabilities

Non-current financial liabilities 34,643.0 34,643.0

Non-current trade payables and other liabilities 3,674.8 3,674.8

Current financial liabilities 11,682.5 11,682.5

Current trade payables and other liabilities 34,238.9 34,238.9

Fair value, total 84,239.2 84,239.2

Book value, total 84,239.2 84,239.2

122